The much awaited Indus Valley report (by Blume Venture Partners) just dropped and we went through all 132 pages of it to get insights for D2C brands. The Indus Valley report is a definitive commentary on the startup ecosystem in India, of which D2C is a major part.

The report categorizes D2C as Digitally Native Brands (DNBs). DNBs are companies that have originated and primarily operate in the digital realm. These brands often leverage e-commerce, social media, and other online platforms as their primary channels for sales, marketing, and customer engagement. They are typically born on the internet and have a strong digital-first approach to business. So lets dive into the key insights

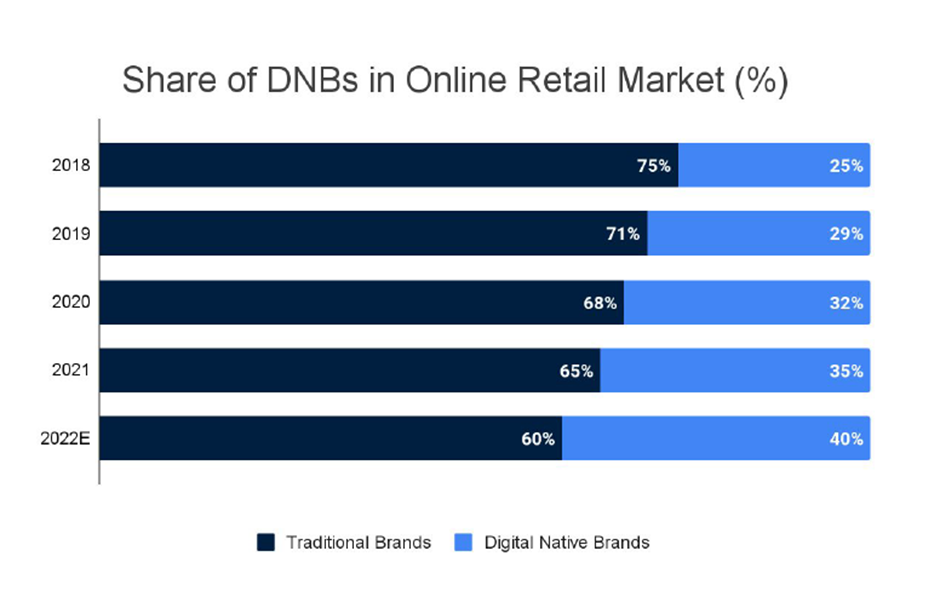

1. Digitally Native Brands Gain Traction ~ 40% of online retail in 2022

The Digitally Native Brands (DNBs) are gaining traction as the online retail is growing. It is disrupting traditional retail landscapes and consumer habits, as their market share is on the rise: D2C %age has grown from 25% in 2018 to 40% in 2022.

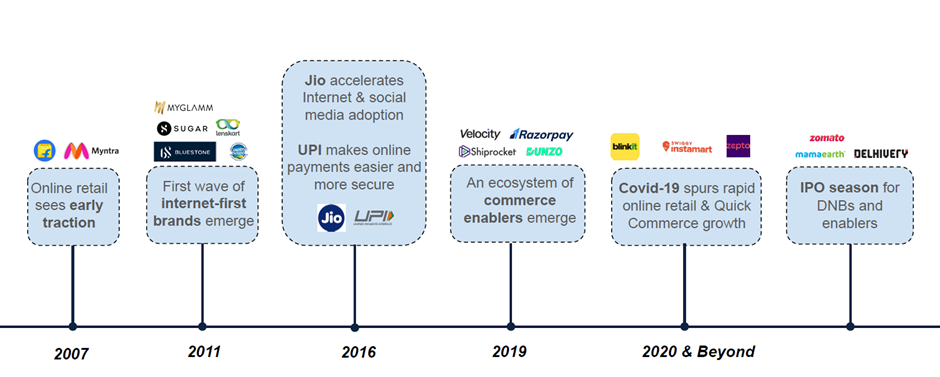

2. Evolution Driven by Digital Adoption:

Although the spur of DNBs started late in the 2000s, multiple factors pushed it to become the large industry it is today. First wave of D2C brands came in 2011, Jio’s internet revolution in 2016, followed by the ease of payments by UPI further accelerated the growth. Not only that, the Covid pandemic further pushed the growth, gaining brand trust and making a large industry it is today.

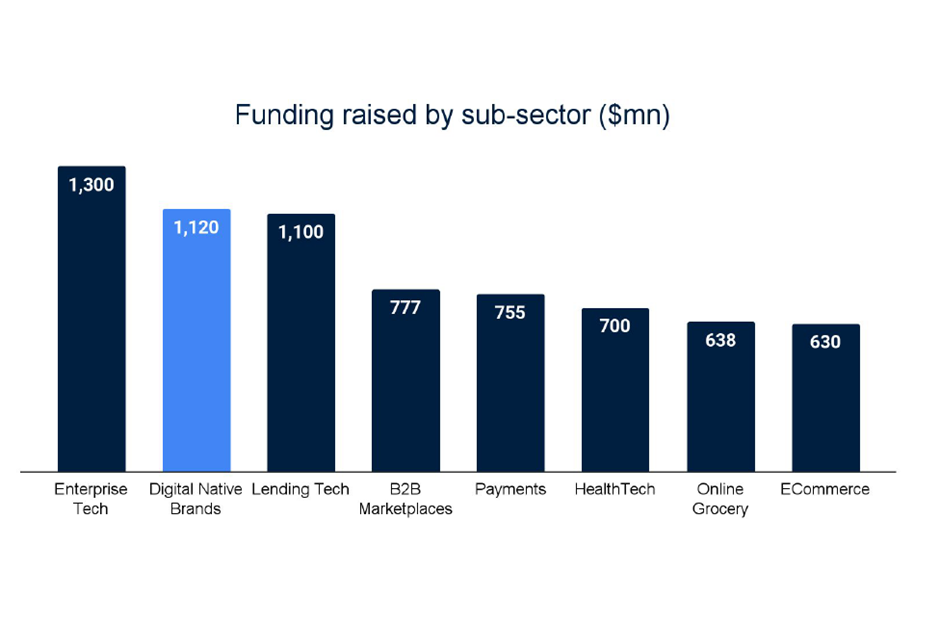

3. Funding Landscape for DNBs ~ 2nd highest funded sector

Following the Covid pandemic, Digitally Native Brands totalled to USD 1.12 Bn of funding raised in 2023 surpassing the leader segments such as B2B Marketplaces, Payments and Health-Tech sector etc, inspiring confidence in the investors with respect to their growth potential.

4. Challenges in Scaling:

Digitally native brands often struggle to scale due to a financing gap. They can be seen as too PE-like for VCs but too small for traditional PEs. This has led to the rise of alternative financing sources like family offices, debt investors, and Revenue-Based Financing (RBF) players. These options bridge the gap between VCs’ expectations and the scale needed for traditional private equity investment.

- Dhanda fluency among D2C brands: Many D2C founders excel in business operations but may lack deep understanding of venture capitalism, termed as Dhanda-Fluent. They try being profitable from the get-go. In response, VCs focusing on consumer brands adapt their approach to better align with the operational expertise and mindset of these founders.

- Crossing the chasm: Brands in the ₹50 – 200 crores revenue range often struggle to secure funding, deemed too PE-like for VCs and too small for PEs. Family offices, debt investors, and RBF players step in to bridge this financing gap for Digitally Native Brands (DNBs).

5. Emergence of D2C Enablers:

An ecosystem of DNB enablers has emerged, offering working capital financing, warehousing, packaging, and marketing analytics. This has created new investment opportunities, catering to the specific needs of digitally native brands and supporting their growth in the market.

- Working Capital Financiers: Fintech companies like Capital Float and Lendingkart provide working capital financing tailored to the needs of digitally native brands.

- Warehousing Services: Companies such as Delhivery and Ecom Express offer advanced warehousing and fulfillment services to support the logistics needs of DNBs.

- Packaging Providers: Indian firms like Bizongo and Packman provide innovative and sustainable packaging solutions for digitally native brands operating in India.

- Marketing Analytics Roll-Ups: Indian companies like Netcore and MoEngage offer advanced marketing analytics and automation tools to help DNBs optimize their marketing efforts.

6. Role of Shark Tank India:

The India franchise of “Shark Tank India” has become a significant promotional platform for the D2C players, providing a boost or a “steroid shot” for the brand visibility and funding opportunities.

“Skippi Ice Pops – the Hyderabad-based popsicle brand fared after bagging a ₹1 crore deal on Shark Tank India S1. Skippi Ice Pops turned the humble chuski, an ice pop, into a multi-crore business, with monthly sales skyrocketing from ₹5 lakh to ₹2 crore after appearing on Shark Tank India”

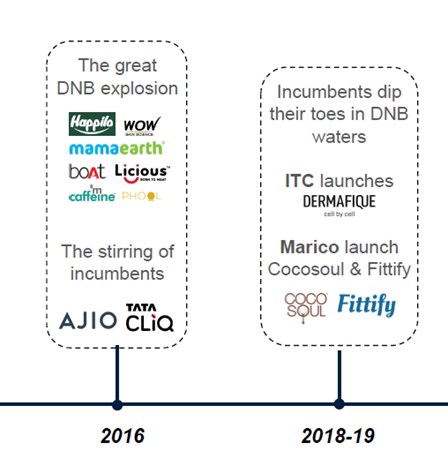

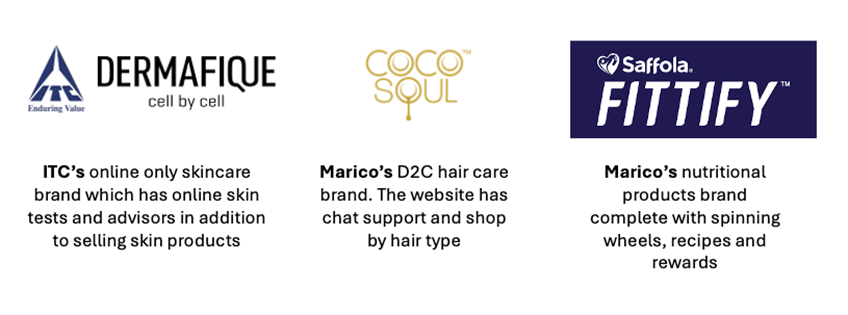

7. Large mainstream brands like ITC experimenting with D2C mode

Incumbents, or the market leaders, following the exponential growth of DNBs also started experimenting with digital channels by launching hyper niche products themselves, as well as acquiring the premium DNBs themselves to add to their portfolio, thus creating a blend of traditional and digital marketplace and strategies. The 2018-19 FY saw these brands going into D2C ventures.

Some examples of new D2C brands by incumbent players are:

8. Insurgents Adopting Traditional Playbooks:

Facing soaring digital advertising and marketplace costs, Digitally Native Brands (DNBs) are pivoting to traditional corporate branding offline. This strategic shift aims for better economic structures and scalability, moving beyond digital channels for cost-efficiency and wider reach.

- Offline Branding: Brands using storefronts to showcase products

Mamaearth offline store

- Influencer Branding: Brands collaborating with influencers to increase market reach

Noise collaborating with Virat Kohli for brand marketing

- Ads: Brands using TV ads as well as campaigns to reach a wider audience

Lenskart TV campaign with Karan Johar

9. Storefront as a Service for Offline Expansion:

D2Cs are embracing physical storefronts to enhance the customer experience, diversify sales channels, and reduce reliance on expensive digital advertising. This offline strategy contributes to brand credibility and fosters a seamless connection between online and offline retail.

LensKart, an online D2C brand with its offline store in India

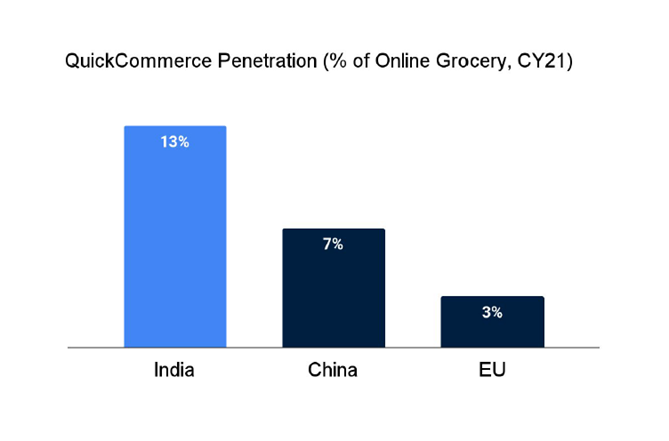

10. Quick Commerce as a Growth Avenue:

Quick Commerce (qCommerce) has become a vital channel for D2Cs enabling rapid product delivery and meeting consumer expectations for instant gratification. D2Cs leverage qCommerce to enhance customer experience and align with the fast-paced nature of digital business. India has the highest qCommerce penetration at 13%, followed by China and the EU.

In conclusion, Digitally Native Brands (DNBs) are navigating challenges and capitalizing on opportunities. From alternative financing solutions to embracing traditional branding and utilizing quick commerce channels, DNBs are adapting strategically to ensure sustained growth in an ever-evolving business landscape.

Read the complete report here